0xScope Newsletter #65: Stronger Portfolio Tracking with Scopechat

Also: 0xScope released its 2024 CEX Market Report

Track Your Portfolio Better with Scopechat’s New Features

Scopechat has rolled out several major updates, aimed at providing a richer portfolio management and market intelligence experience for all of our users.

Since Scopechat launched its AI Portfolio Tracker feature last month, we have listened to user feedback and developed features and enhancements such as:

📊 Manual Portfolio Tracking: Monitor all your assets without needing addresses or API keys. Manually input your trades to further customize your portfolio management experience.

👀 DeFi Positions: Get a comprehensive, easy-to-understand overview of your different DeFi positions across multiple platforms and protocols.

🚦Portfolio Signal Filters: Sort trading signals on any specific token in your portfolio, based on signal type and success rates.

📰 Sort News/KOLs by Token: Filter your portfolio’s news and social media mentions based on your top holdings or specific tokens.

🪙 Daily credits for free users to try Scopechat Pro-exclusive features.

Read this blog for more details.

The 0xScope 2024 CEX Market Report

The 2024 CEX Market Report from the 0xScope team evaluates major shifts in the market shares of various centralized exchanges (CEXs) over the past year. In this year's report, the 0xScope team covered 22 of the biggest CEXes, which processed a total of $54 trillion in trading volume. Here are some of the findings:

📊 Total Volume: Binance retains its leadership of the global CEX market, but its market share has decreased from 51.2% to 41.68%. OKX, Bybit, and Bitget have become the biggest beneficiaries of Binance's market share reduction.

💸 Spot Trading: Binance's market share decreased by 13% YoY but still leads, Bybit jumped from seventh to second place in the rankings.

📈 Derivatives Trading: Binance's market share fell by 8.4% YoY, while OKX, Bybit, and Bitget saw significant gains.

💰 Exchange Tokens: $BNB dominates the market, while $MNT surpasses other tokens in trading volume due to its Layer-2 platform.

On-chain Data

Side $11.7B to CEX asset values

This week, Bitcoin went up from $67,000 to $70,000, then down by as low as $65,000 before returning to its original price at the start. During this whirlwind trend in Bitcoin prices, all major exchanges saw smaller net asset valuations except for one: Bitget with 2.23% growth. The hardest-hit exchange this week was HTX, whose net assets went down by 8.27%, followed by OKX with a 5.18% decline.

Upcoming token unlocks for $ALT, $OP

This coming week, get ready for the unlocking of $21.71M worth of $ALT tokens on October 25, followed by $OP’s unlock of $41.07M in tokens on October 29.

If you're a supporter of these tokens, please be mindful of potential price fluctuations in the days to come, and follow the 0xScope Twitter account for more information.

Company Announcements

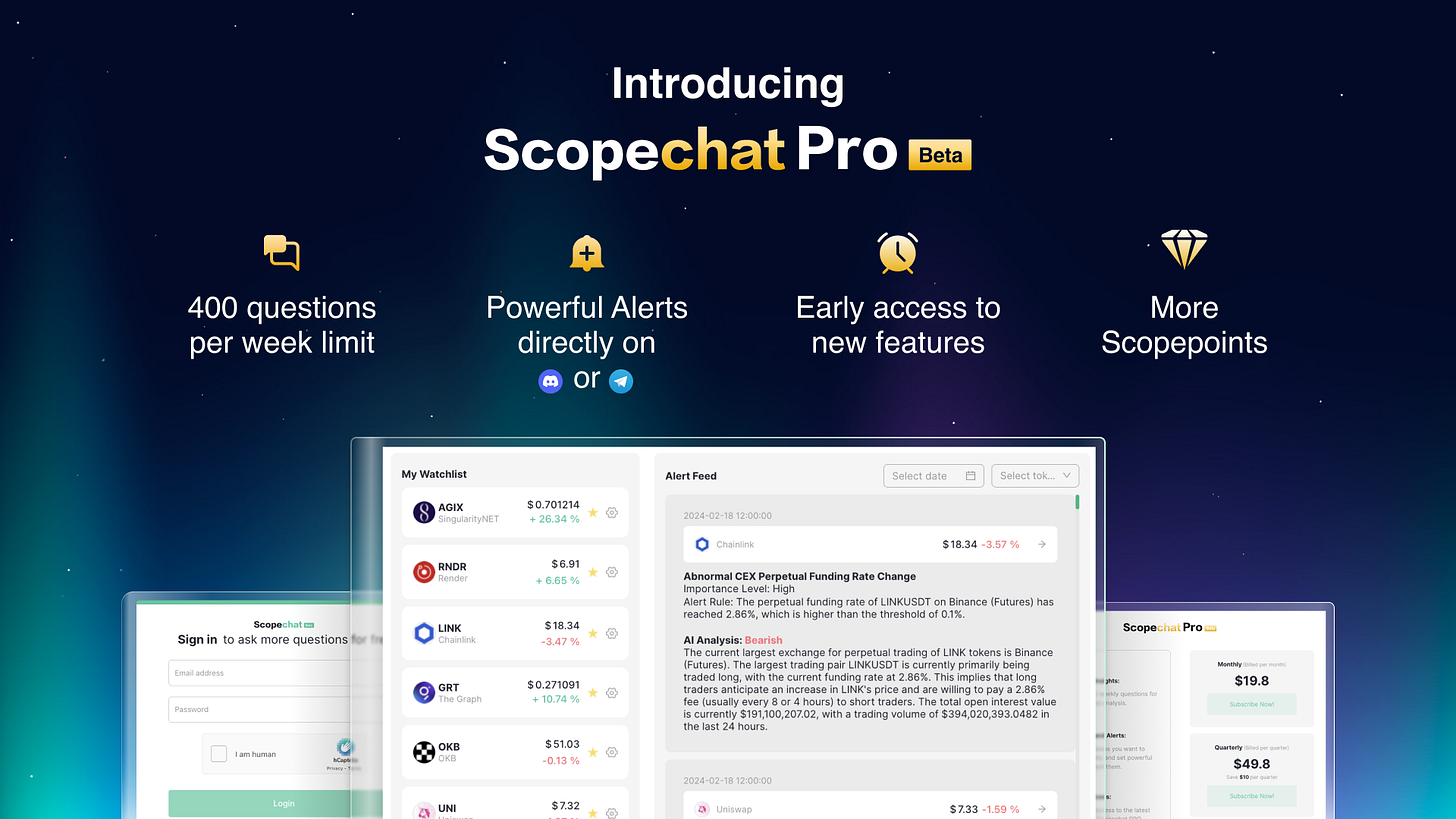

Subscribe to Scopechat Pro

Scopechat Pro is our new membership system for a next-level AI-powered crypto trading experience. With Scopechat Pro, you can enjoy the following benefits for as little as $14/month for the annual plan!

Subscribe to Scopechat Pro today! Pay using your credit card, Scopepoints, or crypto (we support Ethereum, Arbitrum, Base, and Optimism networks).

Be the Next 0xScope Ambassador!

0xScope is looking for talent! Passionate about growing your community and showcasing your investigation skills? Become a 0xScope Ambassador, lead the charge, and get a chance to be featured here! If you think you are a good fit or know somebody who is, please reach out at hr@0xscope.com.

Quick Bites

BTC price aims for $68K as US unemployment beat ups Fed rate cut odds - LINK

Ethereum ‘Verge’ upgrade to enable nodes on phones and smartwatches - LINK

Stripe in $1.1B acquisition deal for stablecoin platform Bridge - LINK

Kraken picks Optimism for new Layer-2 network, joining Coinbase's Base on 'Superchain' - LINK

Binance loses ground to rivals, DEX’s on the rise - LINK

Thanks for reading the 0xScope Newsletter! Learn more about 0xScope: