0xScope Newsletter #48: Scopechat Tips for Buying the Dip

Also: Whale moves on $ETH and $ENA, $16B decline in net exchange assets, and more

Using Scopechat for Buy-the-Dip Opportunities: $CRV Example

$CRV fell from $0.36 to $0.26 today, and its founder is s facing the risk of liquidating his loans on UwU Lend (43M $CRV = $11M in collateral) and Inverse (18M $CRV = $4M).

With Scopechat, you can use AI to find opportunities to buy tokens at their recent bottom value. Here are the steps:

Look for tokens with low AI Scores

Check your chosen token’s Trading Signals dashboard

Hover over the chart to see more details about Trading Signals. For example, with $CRV, we saw these signals:

4859x bigger-than-average CEX deposits of $CRV on Ethereum chain

17x bigger-than-average amount in DEX selling of $CRV on Ethereum chain

Smart Money is trying to buy the dip; their purchases are 12x the recent average.

Check which Trading Signals have high Win Rates (probability of a signal affecting a token’s price)

Set a Token Alert to know immediately when is the right time to buy the dip. (Token Alerts are exclusive to Scopechat Pro users. Subscribe to Scopechat Pro today! )

(Disclaimer: This is not financial advice, do your own research first before investing.)

On-chain Data

Exchanges see $16.6B fall in asset values, many get double-digit drops

Amid a mostly bearish week in crypto trading, major exchanges saw their assets shrink in value by $16.6B, a bigger setback compared to the $1B fall last week. All exchanges are in the red, with Binance accounting for almost $9B of the decline, while the biggest losers percent-wise are Bitget (-16.14%), OKX (-13.50%), and Deribit (-13.02%)

Upcoming token unlocks for $ARB, $APE

This week, watch out for the $88.7M unlock by $ARB on June 16, followed by the $16.99M unlock from $APE the following day.

If you're a supporter of these tokens, please be mindful of potential price fluctuations in the days to come, and follow the 0xScope Twitter account for more information.

Scoped on Scopescan: $ETH, $ENA, and More

Over the past week, the Scopescan team tracked the most significant whale movements. Here are some of those events:

A fresh whale address withdrew 36K $ETH ($127M) from Coinbase.

A whale withdrew 4K $ETH ($14M) from Binance, ahead of the U.S. CPI data and FOMC meeting.

A Safe Multisig withdrew 9.3M $ENA ($6.9M) from Bybit and staked all of it to

Ethena.

A whale withdrew 84.5K $GMX ($3.7M) from Binance as the token’s price rose from $36 to $44.

Don’t miss out on the latest whale movements. Sign up for Scopescan here.

Company Announcements

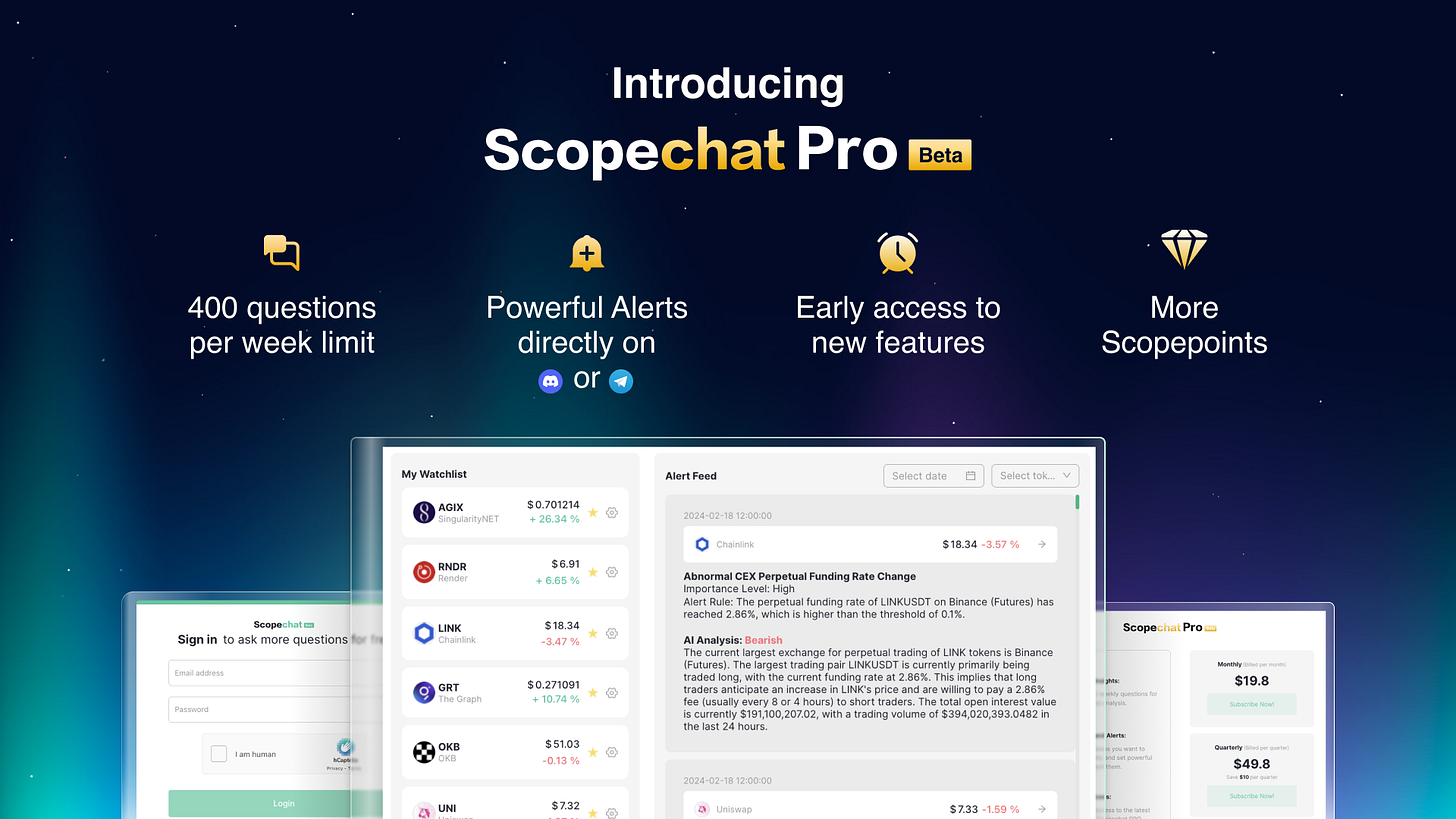

Subscribe to Scopechat Pro

Scopechat Pro is our new membership system for a next-level AI-powered crypto trading experience. With Scopechat Pro, you can enjoy the following benefits for as little as $14/month for the annual plan!

Subscribe to Scopechat Pro today! Pay using your credit card, Scopepoints, or crypto (we support Ethereum, Arbitrum, Base, and Optimism networks).

Be the next 0xScope Ambassador!

0xScope is looking for talent! Passionate about growing your community and showcasing your investigation skills? Become a 0xScope Ambassador, lead the charge, and get a chance to be featured here! If you think you are a good fit or know somebody who is, please reach out at hr@0xscope.com.

Quick Bites

Bitcoin whales scoop up $1.4B in 24 hours amid market correction - LINK

MicroStrategy proposes $500M convertible notes to boost Bitcoin stash - LINK

TON flips ETH in daily active addresses - LINK

CRV slides 30% as loans tied to Curve’s founder face liquidation risk - LINK

Terraform Labs, Do Kwon to pay $4.5B in penalties to SEC - LINK

Thanks for reading the 0xScope Newsletter! Learn more about 0xScope: